For a significant number of businesses engaged in international trade, the Harmonized System (HS) Code is treated as a tactical necessity—a mandatory number required to clear customs. This perspective, while ensuring basic compliance, fails to recognize the code’s profound strategic value. Viewing HS classification as a mere clerical task overlooks its potential to unlock substantial cost savings, mitigate significant risks, and inform critical business strategy.

A proactive and expert-led approach to the HS Code transforms it from a simple compliance obligation into a powerful instrument of competitive advantage. This article explores how businesses can leverage the Harmonized System not just to comply with regulations, but to trade with greater intelligence, efficiency, and profitability.

A Foundation in the Fundamentals

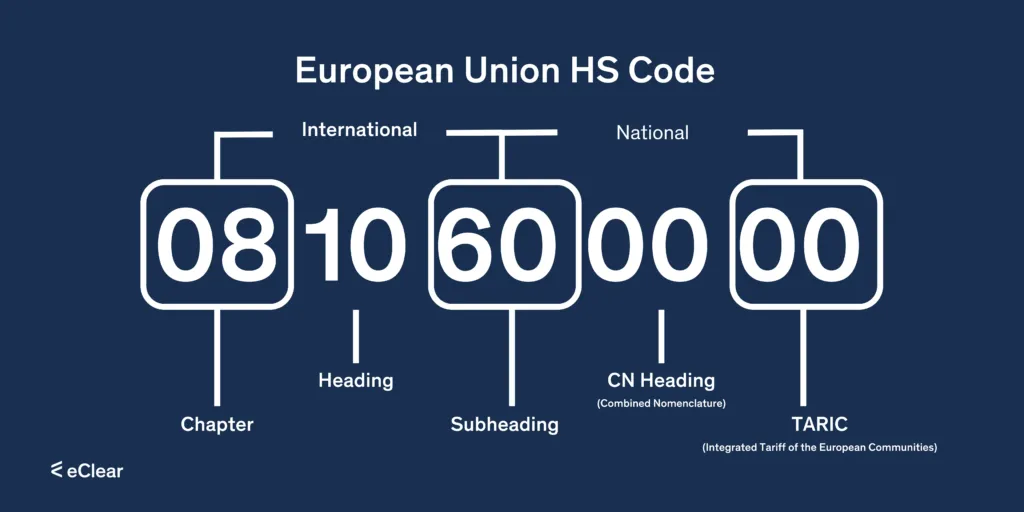

Before delving into strategy, a brief recap of the system is essential. The Harmonized System, maintained by the World Customs Organization (WCO), is the global standard for product nomenclature. Its hierarchical structure provides a logical method for classifying goods.

- Chapters (first two digits) define broad product categories.

- Headings (the first four digits) provide a more specific product group.

- Subheadings (the first six digits) offer a universally recognized, specific product detail.

While these first six digits are standardized globally, individual countries expand upon them to create national tariff lines (e.g., the 10-digit HTSUS in the United States or the EU’s TARIC code) to delineate specific duty rates and collect statistical data. Understanding this structure is the baseline; leveraging it is the strategy.

Strategic Application 1: Tariff Engineering and Duty Optimization

The most direct financial impact of an HS code is the import duty rate it determines. A strategic approach to classification focuses on legally and ethically minimizing this liability.

-

The Concept of Tariff Engineering: This practice involves designing or modifying a product before production with customs classification in mind. By legitimately altering a product’s material composition, primary function, or features, it may qualify for an HS code with a lower duty rate. For example, changing the fiber composition of a garment by a small percentage or including an additional feature on an electronic device could shift it into a different, more favorable tax bracket. This requires deep knowledge of the HS tariff schedule and its interpretive rules.

-

Maximizing Free Trade Agreements (FTAs): The benefits of FTAs, such as reduced or zero tariffs, are not automatic. Eligibility is contingent upon a product meeting specific “Rules of Origin,” which are directly linked to its HS code. A strategic understanding of these rules can inform crucial sourcing and manufacturing decisions. A company might choose to source a particular component from an FTA partner country specifically to ensure the finished product’s HS code qualifies for preferential treatment upon import into another member country.

-

Binding Rulings for Cost Certainty: Applying for a binding ruling from a customs authority should be viewed not as a reactive measure for confusion, but as a proactive strategy. Before launching a new product or entering a new market, securing a binding ruling provides absolute legal certainty on the correct HS code and its corresponding duty rate, eliminating financial risk and allowing for accurate, long-term cost planning.

Strategic Application 2: Market Intelligence and Competitive Analysis

HS codes are the foundation upon which global trade statistics are built. Companies can harness this publicly available data to gain invaluable market intelligence.

-

Informing Market Entry and Expansion: By analyzing import data for specific HS codes, a business can accurately estimate the size of the import market for its products in a target country. This data can reveal consumption trends, seasonality, and the total addressable market, validating or challenging expansion plans with concrete evidence.

-

Competitive and Supply Chain Landscaping: Trade data linked to HS codes allows companies to identify the major countries exporting specific goods or raw materials. This can be used to map out the competitive landscape and identify potential alternative sourcing locations, which is critical for building supply chain resilience and negotiating favorable terms with suppliers.

Strategic Application 3: Proactive Risk Mitigation

A sophisticated understanding of the HS system is a cornerstone of a robust trade compliance and risk management program.

-

Navigating Non-Tariff Barriers: Many of the most disruptive trade barriers are not tariffs but regulations tied to HS codes. These include anti-dumping duties, import quotas, licensing requirements, and specific sanitary or technical standards. A strategic compliance program involves actively monitoring global trade regulations for the HS codes relevant to a company’s product portfolio, allowing the business to anticipate and mitigate potential disruptions before they occur.

-

Managing Controlled and Dual-Use Goods: For industries dealing with technology, chemicals, or other sensitive materials, misclassification can lead to severe penalties, including seizure of goods and criminal charges. An expert-led classification process is the first and most critical line of defense, ensuring that all export control and licensing requirements tied to a specific HS code are rigorously met.

-

Building a Defensible Classification Rationale: Strategic compliance is not just about choosing a code; it is about documenting the justification for that choice. This involves creating a detailed rationale based on the WCO’s General Interpretative Rules (GIRs) and official explanatory notes. This documentation becomes an invaluable asset in the event of a customs audit, providing a logical and legally sound defense for the classification decisions made.

Conclusion: Cultivating Classification as a Corporate Competency

The Harmonized System is far more than a customs formality; it is a complex and nuanced language that governs global trade. Businesses that continue to view HS classification as a low-level administrative task are leaving significant financial and strategic opportunities on the table.

By elevating classification to a strategic function—investing in in-house expertise, leveraging advanced consulting, and integrating HS data into business intelligence and risk management processes—companies can achieve a distinct competitive advantage. In the intricate arena of international commerce, organizations that master the strategic application of the HS Code will be the ones that trade smarter, leaner, and with greater resilience for years to come.